does california have estate or inheritance tax

The federal government does not assess an inheritance tax. 117 million increasing to 1206 million for deaths that occur in 2022.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Californias newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents.

. Like most US. States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritanceAnd even for. The tax is usually assessed progressively.

Notably only Maryland has both an estate and an inheritance tax. If you have additional questions or concerns about estate planning or estate taxes contact us at the Northern California Center for Estate Planning Elder Law by calling 916-437-3500 or by filling out our online contact form. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002.

For most individuals in California this is no longer a major concern. California has no estate tax for individuals who died on or after January 1 2005 and has no inheritance tax for those who died on. Inheritances that fall below these exemption amounts arent subject to the tax.

This means that the tax rate gets higher as the amount exceeds the threshold. California does not have an inheritance tax estate tax or gift tax. All Major Categories Covered.

That being said California does not have an inheritance tax. In fact just six states do Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Effective January 1 2005 the state.

While a state may choose to levy an inheritance tax the federal government. Inheritance tax is calculated based on a tax rate applied to the amount that exceeds an exemption amount. A federal estate tax is in effect as of 2021 but the exemption is significant.

The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. However California residents are subject to federal laws governing gifts during their lives and their estates after they die. Select Popular Legal Forms Packages of Any Category.

According to the Oregon Department of Revenue the tax is called the Oregon Estate Transfer Tax. California also does not have an inheritance tax. Proposition 19 was approved by California voters in the November 2020 election and will result in significant changes to the property tax benefits Californians enjoyed previously under the 1978 Proposition 13 law in effect previously.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. On the other hand you may owe an estate tax and the threshold of 1 million is relatively low. If you live in Oregon you can be happy that you dont have to pay both an estate tax and inheritance tax like people in Maryland.

Each California resident may gift a certain amount of property in a given tax year tax-free. California does not have an estate tax so probate is generally spent verifying the validity of the will and confirming who will act as executor of the estate. People who are starting the estate planning process often wonder about the potential estate or inheritance tax implications.

In 2021 this amount was 15000 and in 2022 this. Inheritance taxes where they apply are levied on a personal level after the estate has been distributed. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

The Oregon Estate Tax. Tax rates usually start around 5 to 10 and generally rise to about 15 to 18. Individuals unrelated to a deceased person however tend to be subject to inheritance tax.

4 The federal government does not impose an inheritance tax. And although a deceased individuals estate is usually responsible for the payment of estate taxes a decedents beneficiaries are responsible for the payment of inheritance taxes. How To Find Out Your Tax Rate.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

What Is A California Life Estate Law Offices Of Daniel Hunt

The Property Tax Inheritance Exclusion

Colorado Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Meeting The Attorney A Four Part Checklist For The Initial Phone Consultation Law Firm Initials Checklist

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Estate Tax Everything You Need To Know Smartasset

Is Inheritance Taxable In California California Trust Estate Probate Litigation

California S Tax On Inherited Properties Hurts Minority Communities Calmatters

California Estate Tax Everything You Need To Know Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

Taxes On Your Inheritance In California Albertson Davidson Llp

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Estate Tax Everything You Need To Know Smartasset

Federal Gift Tax Vs California Inheritance Tax

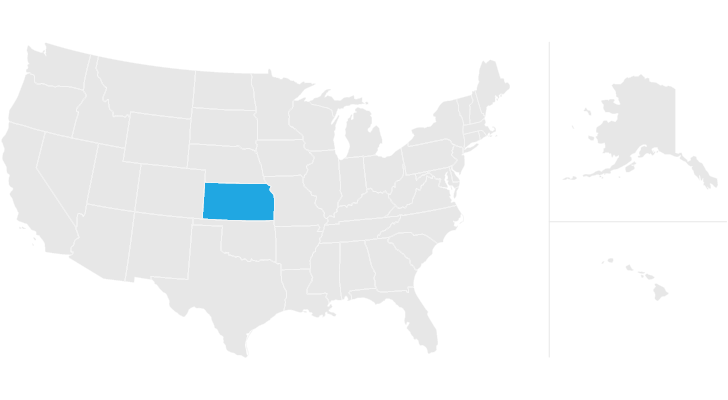

Kansas Estate Tax Everything You Need To Know Smartasset

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit